Drugstore and grocery chains across the nation have been outfitted with glowing kiosks awaiting patients’ names and birthdates for clinic check-ins. Otherwise empty storefront space has been converted to dentist and pediatric offices. Patient databases are filling up in urgent care centers and outpatient clinics. Now minor surgeries, broken bones, or basic lab tests can be handled outside of the hospital setting. The traditional medical office building (MOB) as we know it has been changing for several years. And its expansion outside of the hospital system is causing substantial MOB demand.

Not long ago, even patients in need of simple treatments had to go to a hospital to receive care. Most of the time, basic treatments were more expensive, and even additional parking costs were necessary inconveniences for the patient. But from 2005 to 2016, the number of outpatient facilities rose by 51%. Suddenly, patients had the option of more affordable care, often within a few miles of their homes. The outpatient clinic wasn’t just a trend. It was a huge shift in the medical office building sector. Now that shift has brought a windfall of MOB developments with more demand on the horizon.

Current MOB Data

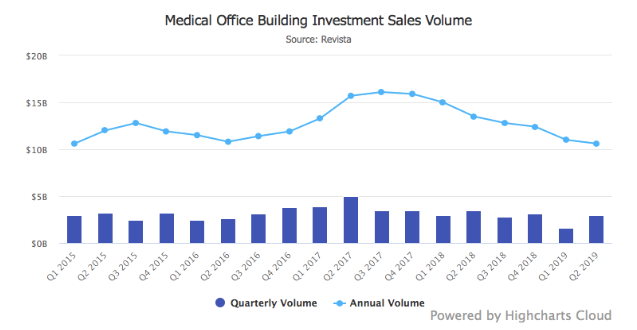

Within the first six months of 2019, about $4.7 billion was spent in MOB trades. As a whole, the sector is down slightly from the last couple of years. But since fewer portfolios are in the market, investors may be holding onto their properties. As of the second quarter of 2019, investment sales were up to $3 billion.

(Source: Nreionline.com/ Revista)

Early on in the market cycle, MOB cap rates were comparable to suburban offices. But over the last 12 months, MOB cap rates have averaged 6.4%. As of the end of Q2 in 2019, they now average about 6.6%. Since the high end of the standard MOB cap rate range is 7%, these are promising numbers. Additionally, the MOB sector had a 13% growth in transaction velocity this year (2019), which is significantly higher than other CRE investments.

MOB Demand

Data from the American Hospital Association says that in 2016, there were nearly just as many surgery centers (5,532) as there were hospitals (5,534). Further data explains that, since 2000, hospitals are down 5%, but surgery centers are up 82%. As of 2018, the amount of square footage and value of MOB construction projects were greater than that of projects completed in 2016–2017. It seems that outpatient and specialty clinics are popping up all over the country.

This intense MOB demand is mirrored by the demand for more physicians. According to the Association of American Medical Colleges, the U.S. will have a deficit of nearly 122,000 doctors by 2032. Longer life spans and the aging baby boomer generation are two of the leading factors increasing the need for more facilities and physicians. Some sources say that by the year 2060, the 85-and-older age group will triple. That is a staggering number and definitely cause for further MOB growth.

The trajectory of the MOB commercial real estate sector is great news for investors and owners of healthcare real estate. With the need for more physicians across a range of specialties, there will be an even greater need for a variety of medical facilities. Longer lease time frames and physicians with consistent patient bases will mean cash flow stability for owners or investors of healthcare facilities. As MOB demand continues to rise, MOB developments will follow suit.

If you are interested in learning more about investing in commercial real estate, or if you have questions about buying, selling, or leasing a commercial property, please contact an HBRE advisor. Our team of experienced CRE professionals have the skills and insight to assist with all property transactions. To reach out to us directly, email [email protected] or call 615-564-4133.