The Outlook of CRE Price Growth

In recent years, the U.S. has been experiencing significant commercial real estate (CRE) price growth. While the extent of price growth seems to be slowing, the Real Capital Analytics (RCA) Index indicates that it’s still moving in an upward direction. This continued price growth could allow the nation to experience more than a decade of CRE appreciation by the year 2021.

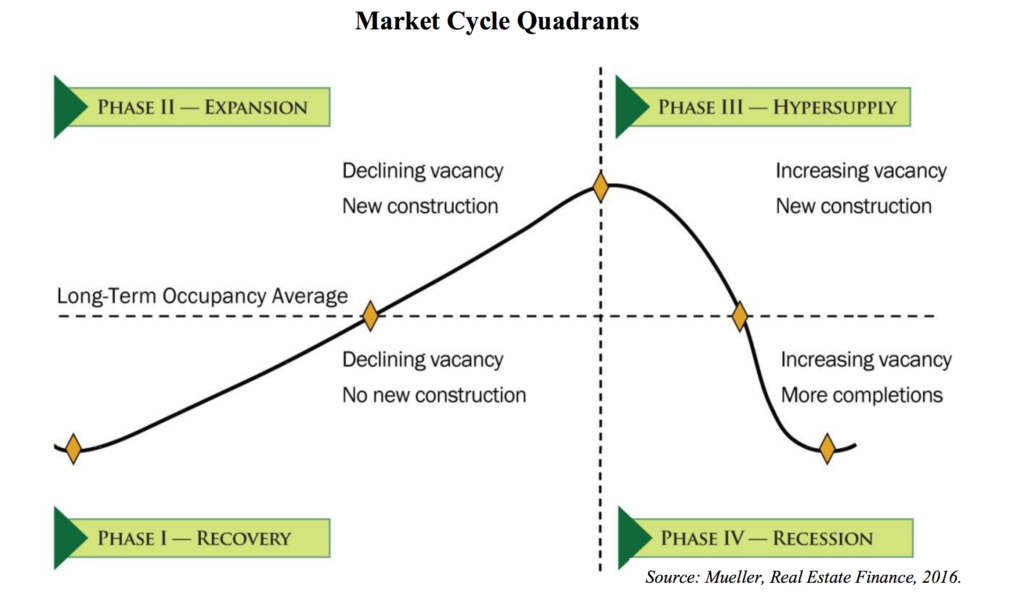

There are four phases in the (CRE) cycle: recovery, expansion, hypersupply, and recession. During the recovery phase, property vacancy decreases, with little to no new construction projects underway. As real estate space becomes less available, the expansion phase begins. The growing need for more facilities yields new construction projects. Eventually, there are more buildings than tenants, causing the market to shift to the hypersupply phase. The increased amount of vacant properties then shifts the state of CRE into a recession. These phases may have variable durations and can also fluctuate by geographic location. But generally, all four cycles occur in a wave-like pattern, which means the cycle continuously repeats itself.

Image by Glenn R. Miller, PhD.

Currently, the U.S. is experiencing the expansion stage. The economy is strong, which, in turn, improves the outlook of the CRE market. Some industry experts are looking for a downturn to take place in the near future. However, despite the long-lasting current expansion cycle, CRE prices are continuing to rise. For example, there was a 1.1% price increase from April to May of this year. There hasn’t been such a significant price increase since 2015.

CRE Price Growth Factors

Several factors contribute to CRE price growth. Demographics, interest rates, new legislation, and the state of the economy can all shift the market in one direction or the other. For example, demographics, such as age, gender, income, etc., impact the need for vacation properties, retirement homes, and medical facilities. Interest rates affect the value of REITs; the higher they are, the more desirable a REIT becomes. Legislation, like tax credits, deductions, etc., can also temporarily increase or diminish investor interest in CRE. And naturally, economic changes impact businesses and could determine whether those entities have the resources to grow into new real estate.

The Demand of MOB Real Estate

The medical field is a prime example of how these elements impact CRE. Over the last few years, new laws have been a deciding factor for buyers of medical real estate. Healthcare Acts and the talk of future healthcare changes are causing buyers to weigh and measure their need to expand against their CRE investment plans. Demographics are also having a substantial impact on the medical field.

The aging baby boomer demographic is currently increasing the need for more medical clinics and specialized facilities. More facilities are opening outside of the metropolitan areas, which could be part of the reason that prices are rising. RCA noted that in Q1 of 2019, CRE prices rose faster in less urban areas than in six of the major metro U.S. cities. The list includes Washington D.C., Chicago, Los Angeles, and other notable cities. Naturally, with the increase in demand for CRE in suburban areas, investors would like to see an increase in other areas of the market, too.

The immediate future of CRE price growth is still to be determined. Industry experts have differing future predictions regarding when the next downturn will take place. As of now, CRE, especially MOB real estate, pricing continues to rise. There is hope that the demand and healthy economy will allow CRE price growth to continue for the next several years.