For an update on how COVID-19 is affecting the healthcare real estate sector, visit our blog, “The 2021 Outlook for Healthcare Real Estate.”

While the four main sectors of CRE typically take the media spotlight, healthcare real estate is quickly becoming the topic of conversation. Though it is a niche market, healthcare real estate will be bringing significant impacts in the coming year. Commercial real estate (CRE) owners and investors should keep an eye on these important updates for healthcare real estate in 2020.

“Medtail” CRE

Retail CRE locations that have integrated healthcare options, such as drugstore clinics, are becoming more prevalent. Small towns and suburban areas that were once devoid of local medical facilities are beginning to see options like the CVS minute clinic or Kroger’s Little Clinic. As these retail chains search for ways to stay relevant in the changing consumer experience trend that is covering the retail sector, drugstore clinic locations may increase in 2020.

Urgent care centers have also been popping up in retail strip malls. Theses “medtail” healthcare facilities offer another avenue of outpatient care to suburban residents. The aging baby boom generation is now able to find less expensive care closer to their homes. And parents of young children are drawn to the quicker, yet specialized care for their kids. These localized facilities usually handle both the immediate medical need and follow-up treatments. Patients remain in their databases, allowing the business side of the healthcare facility to remain profitable, long-term. It’s a beneficial model for both the healthcare practice and the patient that is likely to continue to increase.

Technology in Healthcare Real Estate

Technology, which seems to be the catalyst across many quickly advancing industries, is also improving healthcare real estate. Medical practices are using more in-depth patient record software, shareable across their many branches. Technology has also given practices the ability to handle more specialized, outpatient procedures outside of a hospital setting. Additionally, more telemedicine and in-home care programs are allowing medical facilities to reduce their wait times and serve more patients. With an increased patient base on the horizon, these tech improvements can continue to expand their services and possibly their CRE footprints.

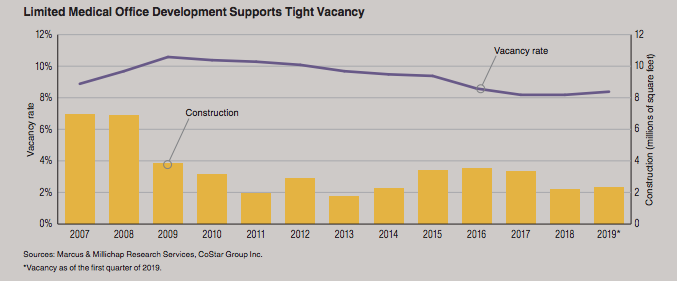

Vacancy Rates and Demand

At the beginning of 2019, medical office vacancy rates held steady at 8.5%. Meanwhile, the traditional office vacancy rate was 13.3%. This infers that the medical sector is outperforming the office sector. And while healthcare real estate growth has been mild, it is trending upward, and it is still ahead of the traditional office sector. As the amount of medical school graduates is also continuing to increase, there is even more of a positive outlook for medical office CRE growth.

Image Source: https://ulidigitalmarketing.blob.core.windows.net/emergingtrendspdfs/ET2020FallMeeting.pdf

Smaller Facilities Merging with Health Systems

In recent years, more health systems have merged with physician-owned practices. In some cases, the individually-owned facilities do not have the modern layouts and tech advances necessary for a larger health system. As a result, some existing healthcare properties may not be picked up by these larger systems. But there is still a push toward health system expansion, which makes the medical office building (MOB) sector a very desirable portion of investors’ portfolios. Both seasoned and new investors will be experiencing the benefits of medical real estate investments.

The aging population and increased use of health insurance in the United States has brought a heavy demand for medical practices and MOB real estate. From investors looking for a recession-resistant investment option to suburban residents seeking more localized care, all eyes are on the medical sector. The year 2020 is positioned to bring expansion and innovation to the healthcare real estate submarket of commercial real estate.