Strong GDP and job growth in 2018 is paving the way for strong real estate demand and absorption all the way up to 2020, according to the semiannual Urban Land Institute (ULI) Real Estate Economic Forecast.

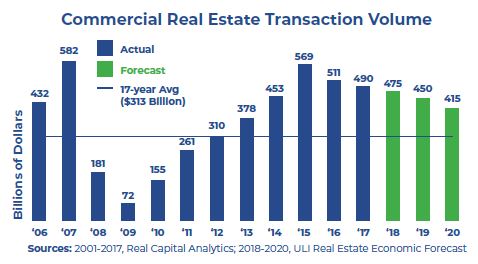

According to the forecast, commercial real estate transaction volume will continue to drop in 2018, following the declines in 2016 and 2017, off the post-recession peak of $569 billion of transaction volume in 2015. The forecast for

this year is predicted to peak at $475 billion, whereas the predictions for transaction volume in 2019 and 2020 are $450 billion and $415 billion respectively.

Even with the predicted declines in transaction volume over the next 3 years, the CRE activity will still be much higher than the past 17-year annual average of $313 billion, according to the forecast.

Although economists are split on the timing of the next recession, most believe that it will occur around 2020-2021 or later, according to data from the National Association of Business Economists.

Sources: urbanland.uli.org, globest.com