As we’ve noted in several articles over the past year, medical real estate transaction volume and demand remains strong, due in large part to a population that is aging.

A recent medical office building in Houston was purchased for the largest price ever paid for a medical facility in U.S. history, and many believe this is yet another example of a trend of continued high demand for medical real estate. LaSalle Investment Management’s property fund purchased the Memorial Hermann Medical Plaza for a record $405 million. The building is a 28-story, 500,000 square-foot facility that is 99 percent occupied.

Although, many business economists are predicting a coming recession at some point in the next few years and decreased growth in commercial real estate transactions, medical office buildings and facilities are considered a much safer investment than other commercial real estate because of the continued and projected growth in demand due to the medical needs of an older population group.

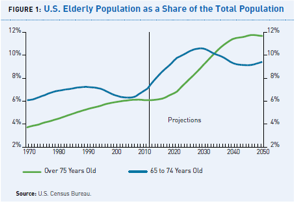

An aging population, soon to reach historic levels here in the U.S., generally means an increased need for doctor visits, medical procedures, and treatments. More people are reaching retirement age faster than ever before in U.S. history. The unprecedented aging baby boomer population is a strong factor in this continued demand for medical real estate both now and in decades to come.

In its Outlook for Health Care report, the Urban Land Institute stated that “those over 65 years of age have three times as many office visits per year as people under 45…” and that “(t)he government estimates that Medicare and Medicaid expenses will leap from 6.4 percent of gross domestic product (GDP) this year to 10.7 percent in 2029.”

The demand for medical office buildings is expected to increase 19 percent by 2019, in large part because of population growth and new healthcare laws. Because MOBs have shown much less volatility exhibited by more stability in their capitalization and vacancy rates in comparison to other types of commercial real estate such as retail and office buildings, and residential real estate, it is projected that MOBs will not be faced with continuing excess capacity in future years like these other real estate sectors have been dealing with.

Sources: americas.uli.org, beckershospitalreview.com