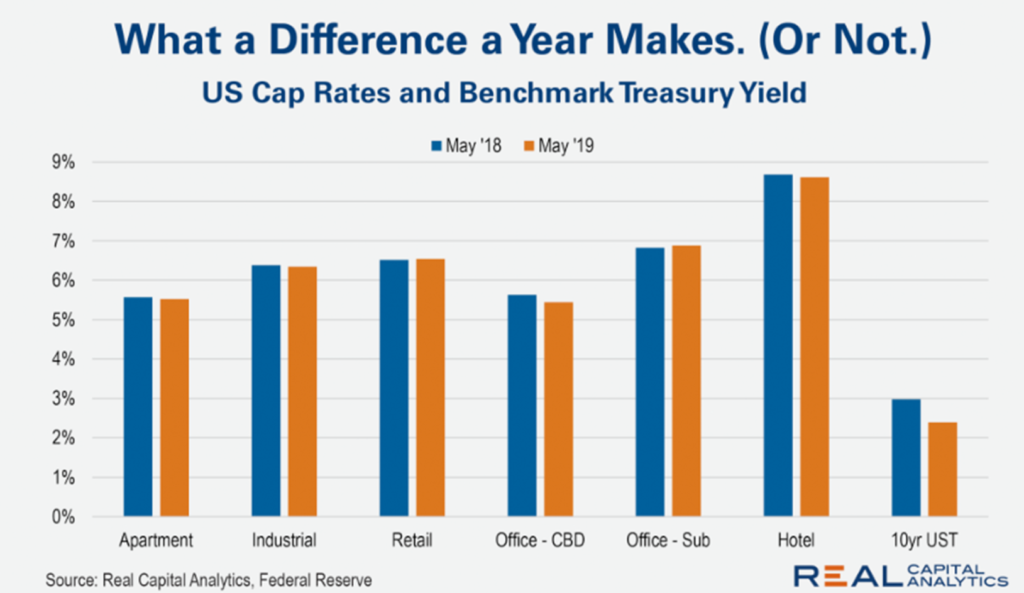

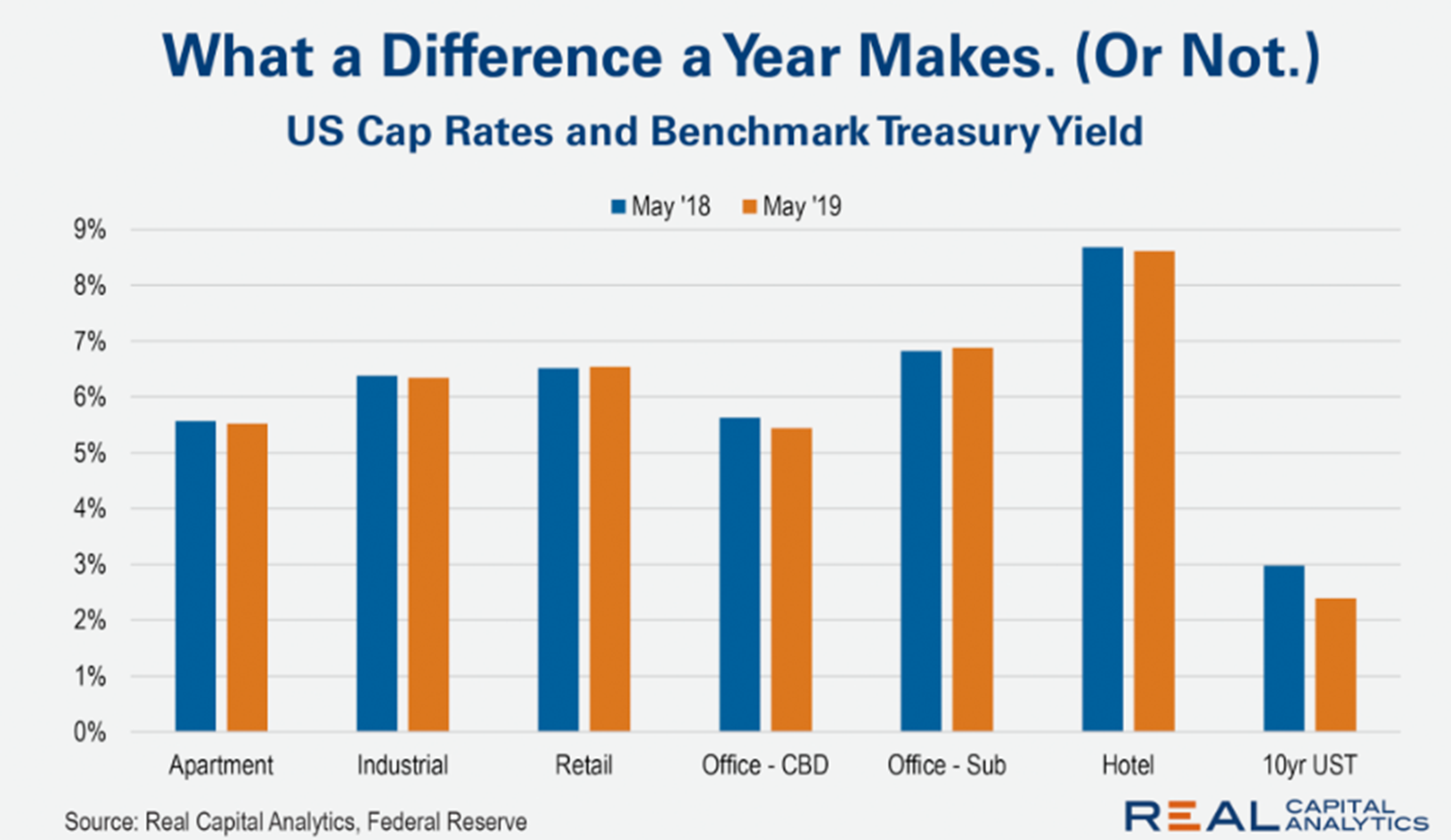

In the last year there has been little substantial movement in capitalization rates across the commercial real estate property sectors. A few factors could make an impact on market activity and cap rates in the coming months, including whether the Federal Reserve decides to cut interest rates later this year. The Fed recently indicated that rate cuts could be a possibility. The Fed meets in August to discuss monetary policy issues, and due to concerns over trade barrier issues and potentially future slower economic growth, many leading investors expect cuts to be made in the fed funds target rate through the remainder of 2019. If the rate is cut, this could lead to a surge in commercial real estate activity in the coming year.

Sources: Real Capital Analytics www.rcanalytics.com, https://www.cnbc.com