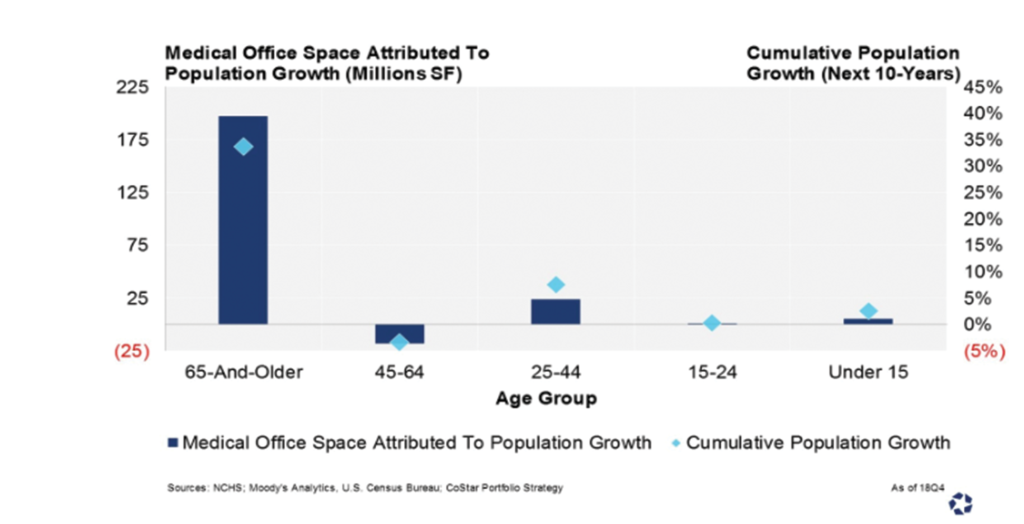

Medical Office Demand To Continue to Increase in Coming Decade

The demand for the amount of medical space needed in the next 10 years is projected to be 16% more than is currently available today. Investment dollars generally flow into a sector where a continued higher demand creates a more consistent cash flow model due in part to longer term leases and lower vacancy rates. […]

Medical Office Demand To Continue to Increase in Coming Decade Read More »