2019 Outlook for Commercial Real Estate

The Commercial Real Estate (CRE) industry experienced its ninth consecutive year of growth as rents and valuations continued to increase across all sectors of the industry. Many industry experts predict that 2019 will continue to see growth, although at a slower pace.

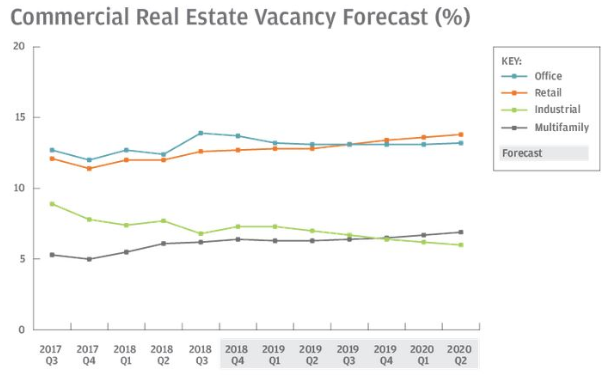

The Rate of Growth is Slowing Across the CRE sectors

Office, industrial and multifamily sectors are expected to experience continued growth, albeit at a slower rate than the past few years. However, the retail sector is of most concern to many analysts. The brick-and-mortar retail stores, such as grocery stores, that do not compete as intensely with online retailers, should be fine. However, the big box stores and retailers that sell other consumer items that have seen market share continue to be lost to internet sales are expected to continue losing ground to online retailers.

Source: National Association of Realtors

Urban Residential Demand Increasing with Millennials

In contrast to the suburban-dwelling previous generations who commute daily from the suburbs to the city for work, this younger generation of Americans prefer to live, work and play in the city. At an increasing rate over the last several years, the demand among millennials for apartment rental units and condos in urban areas has caused a domino effect for demand of other commercial real estate sectors including office and retail in many urban areas.

The Impact of Interest Rates

Although interest rates have risen over the last year, the Federal Reserve has given signals that it may keep interest rates steady through the rest of the year. Some analysts think the Federal Reserve may even decrease in the next year, especially if the U.S. slips into a recession. With interest rates still near historic lows and uncertainty as to when rates may go up again, purchasing commercial real estate and locking in long-term low interest rates could be a wise move for investors.

Effects of National Economy

Although many analysts have been incorrectly predicting a recession to begin for years, the economy overall has remained strong. When a recession finally does come, a light recession that impacts a certain industry or does not reverberate across the entire economy may only cause minor effects to the commercial real estate market. However, a major recession like the one in 2008, could cause massive repercussions across every CRE sector. The impact of a potential trade war with China or other countries could also affect demand and pricing for commercial real estate.

When a correction does come to the US economy, it is important to be prepared. If you are a CRE owner, keep fundamentals in mind when making decisions on rate renewals and taking on debt and expenses. Preparing for a market of decreased demand for commercial space and resulting lower rates could include keeping competitive rental rates steady and increasing liquidity levels to prepare for a decrease in income resulting from vacant space.

Let HBRE become a trusted resource for all your commercial real estate needs. Reach out to us at 615-564-4133 or find us online at hbre.us.

Sources: https://www.globest.com; https://www.jpmorgan.com/commercial-banking/insights/2019-commercial-real-estate-outlook